Public Offering Preparation and Brokerage

We aim to raise the credibility and prestige of companies while financing the growth of companies through public offerings with our identity as a pioneering institution which carries out initial public offerings in Türkiye.

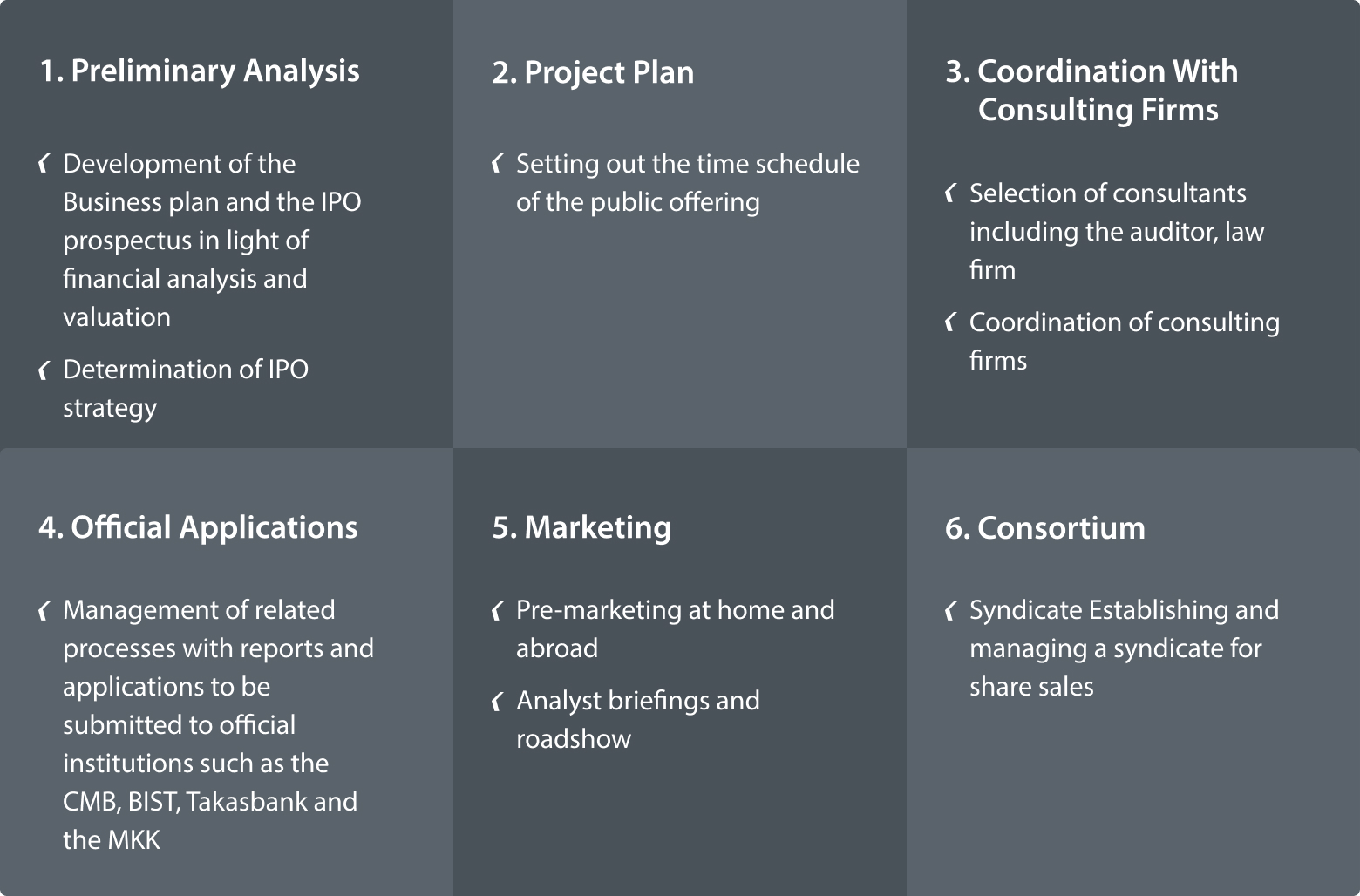

Within the scope of our public offering brokerage service, we provide pre-offering preparation, infrastructure transformation consultancy, stabilization during and after the IPO and research support within the scope of our public offering brokerage service.

We are with you every step of the way in ensuring a successful public offering process.

- Determining the public offering strategy and drafting the public offering prospectus and timing

- Support in the execution of processes related to the CMB, Borsa İstanbul, MKK (Merkezi Kayıt Kuruluşu A.Ş.) and preparation of relevant documentation.

- Providing support in the selection of all other consultants such as the independent audit firm and legal consultant involved in the public offering process and coordination of the teams

- Coordination of public offering advertising and PR (Public Relations) activities

- Execution of sales and marketing activities

- Preparation of the research report

- Domestic and foreign roadshows

- Creation of the consortium

- Requesting collection

- Conducting distribution and finalizing legal notices

- Price stability transactions after the initial public offering

- Publishing a research report regarding companies which regularly offer their shares to the public

What the Public Offering will bring your company

- The ability to use additional loans and the opportunity to issue debt instruments with the additional guarantee provided by the increased capital following the public offering.

- Trading of shares offered to the public in the organized market and providing liquidity opportunity to existing partners.

- Increased credibility in the banking and money market with the company's shares being traded on the BIST

- Accelerating the institutionalization processes of publicly traded companies through the control mechanisms of the capital market, and rapid access to transparent and professional management opportunities.

- Disclosing company information to the public and providing recognition in domestic and international markets.

- Increasing the company's access to foreign markets, with the possibility of establishing a joint venture with a foreign company.

- Quickly meeting the company's additional equity needs through secondary offerings

The IPO (Initial Public Offering) process